Editor’s note: This is a recurring post, regularly updated with new information.

Skiing usually makes for an expensive family vacation, and some of the biggest purchases are lift tickets and lessons.

Although $35-plus daily lift tickets still exist out there at some smaller mountains, you can expect to spend anywhere from $100 to upward of $200 per day on lift tickets at some of the most prominent mountain resorts in the U.S. One alternative to the hefty per-day costs is a multimountain season pass, such as the Epic or Ikon passes, that cost $600 to $900-plus per adult per season.

Need ski school? That runs more than $200 per day at major resorts, and private lessons are several times that amount.

Those are (very) painful numbers for most of us to swallow. The silver lining is that you can earn many points on these big-ticket winter vacations with your rewards credit cards.

So, which card is the best one for your ski trip?

Bonus categories for lift tickets and lessons

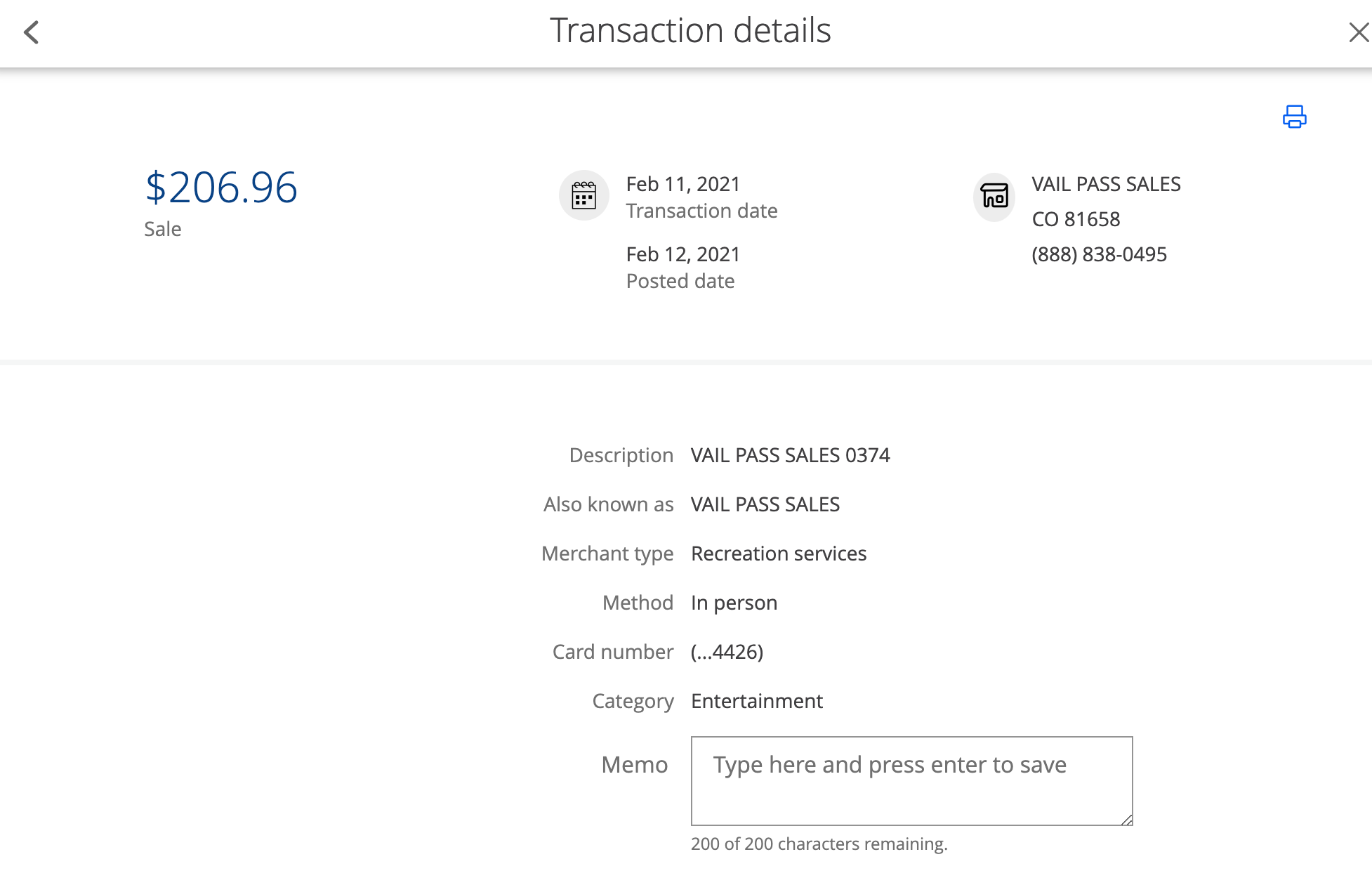

The purchases may code differently depending on how and where you buy your lift tickets and lessons. Unfortunately, you won’t know how these purchases will code until the charges post. But to help you make an educated guess, here are some ski purchase examples from TPG staffers and readers:

Coded as entertainment

- Epic Pass

- Mountain Collective season pass

- Liftopia lift tickets

- Breckenridge lift tickets and ski school

- Keystone lift tickets, ski school and tubing

- Heavenly ski school

- Deer Valley lessons and tickets

- Crotched Mountain lift ticket

- Telluride lift ticket

- Vail lift ticket

Coded as travel

- Whitefish Mountain advance-purchase lift tickets

- Tremblant lift tickets and rentals

- Copper Mountain season pass and day lift ticket

See what we mean by the absence of consistent purchase codes? This is harder than deciding between the Simba and Poppyfields runs at Vail.

Overall best credit card for ski charges

Since ski lift tickets and lessons tend to code either as travel or entertainment, your safest bet is to use a card that offers a flat rewards rate. For example, the Capital One Venture Rewards Credit Card (see rates and fees) awards 2 miles per dollar on all purchases.

It’s also a pretty good card for all other purchases since you’ll always earn 2 miles per dollar. Capital One Venture miles are transferable to several hotel and airline partners. TPG currently values them at 1.85 cents each, giving you a solid return of 3.7%.

Or, you may decide to opt for your Chase Sapphire Reserve; your ski charges may post as travel or dining at 3 points per dollar. In that case, you could be looking at a return of 6% since Ultimate Rewards points are worth 2 cents each. But if your ski expenses don’t charge in those categories and instead code as entertainment, you’ll earn just 1 point per dollar. Yes, that happened with me and a pricey Vail ticket when I charged it to my Sapphire Reserve.

Cards that offer bonus points on entertainment

If you know your ski charges will code as entertainment, the Capital One Savor Cash Rewards Credit Card*, the Capital One SavorOne Cash Rewards Credit Card (see rates and fees) and the U.S. Bank Cash+® Visa Signature® Card offer bonus points on entertainment. Here is how the three cards compare:

| Card | Sign-up bonus | Rewards rates | Annual fee |

| Capital One Savor Cash Rewards Credit Card* | Earn a one-time $300 cash bonus once you spend $3,000 on purchases within the first three months from account opening. |

|

$95 |

| Capital One SavorOne Cash Rewards Credit Card | Earn a one-time $200 cash bonus after spending $500 on purchases within the first three months of account opening. |

|

$0 |

| U.S. Bank Cash+ Visa Signature Card* | Earn $200 after you spend $1,000 in the first 120 days of account opening. | 5% cash back on your first $2,000 in combined eligible purchases each quarter on two categories you choose | $0 |

*The information for the Capital One Savor Cash Rewards Credit Card and the U.S. Bank Cash+ Visa Signature Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Cards that offer bonus points on on-mountain meals and dining

When you spend the day skiing or boarding, you will get very hungry. Sadly, on-mountain meals often come at a pretty steep markup. But again, the small upside of higher prices is more points.

Although our results are not 100% consistent, most on-mountain dining usually codes as dining/food and drink. We have occasionally seen on-mountain meals code as general merchandise instead of dining, but for the most part, I’d use the card in your wallet that is best for dining.

This may be the American Express® Gold Card with 4 points per dollar at restaurants, the Chase Sapphire Reserve with 3 points per dollar on dining or the Bilt Mastercard® with 3 points per dollar on dining.

Related: The best credit cards for dining

Cards that offer bonus points on travel

If you know for sure a ski charge will post as travel (and that’s likely with bundled lodging and lift ticket packages), below are the best cards to use for that expense. Another idea to encourage your ski expenses to code as travel is to purchase your lift tickets or passes via Undercover Tourist. It doesn’t have all ski resorts available, but purchases on that site typically code as a travel charge. (We often use it for Disney, too.)

| Card | Category bonus: Travel | Value of the rewards | Return (based on TPG’s valuations) | Annual fee |

| Chase Sapphire Reserve | 3 points per dollar | 2 cents | 6 cents | $550 |

| Chase Sapphire Preferred | 2 points per dollar | 2 cents | 4 cents | $95 |

| Bilt Mastercard | 2 points per dollar (or 4 points per dollar on travel purchases the first of every month, up to 10,000 bonus points per month) | 1.8 cents | 3.6 cents (or 7.2 cents on the first of the month) | $0 |

| Bank of America® Premium Rewards® credit card | 2 points per dollar | 1 cent | 2 cents (up to 3.5 cents with the Bank of America Premium Rewards program) | $95 |

Other cards that offer bonus points for everyday spending

If you aren’t sure how a ski expense will code, using a card that is strong on everyday spending isn’t the worst plan.

| Card | Category bonus: All other purchases | Value of the rewards | Return (based on TPG’s valuations) | Annual fee |

| The Blue Business®️ Plus Credit Card from American Express | 2 points per dollar on the first $50,000 in purchases each calendar year, then 1 point per dollar | 2 cents | 4 cents | $0 (see rates and fees) |

| Bank of America Premium Rewards credit card | 1.5 points per dollar | 1 cent | 1.5 cents (up to 2.25 cents with the Bank of America Premium Rewards program) | $95 |

| Chase Freedom Unlimited | 1.5% cash back | 2 cents (if you also have a premium Ultimate Rewards card) | 3 cents (with a premium Ultimate Rewards card) | $0 |

Additionally, the Bilt Mastercard — a strong credit card for your travel and dining purchases — offers 2 points per dollar on all purchases made on the first of the month (except rent), up to 10,000 bonus points per month. This means if you time your lift ticket purchase to the first of the month, you could ultimately earn 2 points per dollar spent. And with Bilt points worth 1.8 cents per point, this will give you a 3.6% return.

Related: Your complete guide to the Bilt Rewards program

Bottom line

We found that the Capital One Venture Rewards (see rates and fees) is the overall best credit card for ski trips, thanks to its bonus points on all charges.

However, if you make your ski trip purchase on the first of the month, then the Bilt Mastercard is also a strong contender.

Although most of our ski-related charges are coded as entertainment, your results may vary based on where you ski and where you purchase your lift tickets, ski school, etc. Of course, any necessary flights and lodging will likely code as travel.

Or, better yet, use your miles and points to get you to the powder and then let your credit card do the rest.

For rates and fees for the Blue Business Plus card, click here.