Editor’s note: This is a recurring post, regularly updated with new information and offers.

Historically, you could only redeem Capital One miles at a fixed value. But in 2018, Capital One added transfer partners as an additional redemption option for some of its cards. Capital One has since added new transfer partners at mostly a 1:1 transfer ratio.

Capital One currently has more than 15 airline and hotel transfer partners. In this guide, we’ll discuss how to earn Capital One miles and then walk through each Capital One transfer partner so you can decide which ones to learn more about.

How to earn Capital One miles

Some, but not all, Capital One credit cards earn Capital One miles. Here’s a list of some currently available consumer cards that earn transferable Capital One miles:

- Capital One Venture X Rewards Credit Card: Earn 10 miles per dollar on hotels and rental cars booked through Capital One Travel, 5 miles per dollar on flights booked through Capital One Travel and 2 miles per dollar on other purchases. Plus, you can earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening; $395 annual fee (see rates and fees).

- Capital One Venture Rewards Credit Card: Earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel and 2 miles per dollar on other purchases. Plus, you can earn 75,000 bonus miles once you spend $4,000 on purchases within the first three months from account opening; $95 annual fee (see rates and fees).

- Capital One VentureOne Rewards Credit Card: Earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel and 1.25 miles per dollar on other purchases. Plus, you can earn 20,000 bonus miles once you spend $500 on purchases within the first three months from account opening; $0 annual fee (see rates and fees).

If you’re looking for a business card, here are some options that earn Capital One miles:

- Capital One Venture X Business: Earn 10 miles per dollar on hotels and rental cars booked through Capital One Travel, 5 miles per dollar on flights booked through Capital One Travel and 2 miles per dollar on other purchases. Plus, you can earn 150,000 bonus miles when you spend $30,000 in the first three months; $395 annual fee (see rates and fees).

- Capital One Spark Miles for Business: Earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel and 2 miles per dollar on other purchases. Plus, you can earn a one-time bonus of 50,000 miles once you spend $4,500 on purchases within the first three months of account opening; $0 introductory annual fee for the first year, then $95 after (see rates and fees).

- Capital One Spark Miles Select for Business: Earn 1.5 miles per dollar on purchases. Plus, you can earn a one-time bonus of 50,000 miles once you spend $4,500 on purchases within the first three months from account opening; $0 annual fee.

The information for the Capital One Spark Miles Select has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

You’ll need at least one of the above cards to earn Capital One miles. But, once you have a card that earns Capital One miles, you can convert cash back from your other Capital One cards into miles. So, it might be worth pairing one of the above cards with some of our favorite Capital One cash-back cards, such as the Capital One SavorOne Cash Rewards Credit Card, if you’re looking to boost your stash of Capital One miles.

Related: Chase Sapphire Preferred vs. Capital One Venture Rewards: Which $95 card should you get?

Capital One transfer partners overview

As mentioned above, Capital One has more than 15 transfer partners. Here’s each of the Capital One transfer partners and the ratio at which you can transfer Capital One miles to each partner:

- Aeromexico Rewards: 1:1 transfer ratio

- Air Canada Aeroplan: 1:1 transfer ratio

- Air France-KLM Flying Blue: 1:1 transfer ratio

- Accor Live Limitless: 2:1 transfer ratio

- Avianca LifeMiles: 1:1 transfer ratio

- British Airways Executive Club: 1:1 transfer ratio

- Cathay Pacific Asia Miles: 1:1 transfer ratio

- Choice Privileges (only U.S.-based accounts): 1:1 transfer ratio

- Emirates Skywards: 1:1 transfer ratio

- Etihad Airways Guest: 1:1 transfer ratio

- EVA Airways Infinity MileageLands: 4:3 transfer ratio

- Finnair Plus: 1:1 transfer ratio

- Qantas Frequent Flyer: 1:1 transfer ratio

- Singapore Airlines KrisFlyer: 1:1 transfer ratio

- TAP Air Portugal Miles&Go: 1:1 transfer ratio

- Turkish Airlines Miles&Smiles: 1:1 transfer ratio

- Virgin Red: 1:1 transfer ratio

- Wyndham Rewards: 1:1 transfer ratio

Not all of these transfers will occur immediately. So, check out our guide to Capital One transfer times to see how long transfers to each partner usually take.

Related: Tips and tricks to get maximum value from your Capital One miles

Best Capital One transfer partners

TPG’s valuations peg the value of Capital One miles at 1.85 cents each. But the value you’ll get from your Capital One miles depends on how you redeem them. So, to help you get a high value from your miles, we’ll discuss some of the best Capital One transfer partners in this section.

Air Canada Aeroplan

The Air Canada Aeroplan loyalty program saw significant changes in 2020. Now, the Aeroplan award chart lists award ranges for Air Canada flights but has fixed rates for most partner awards.

Aeroplan doesn’t pass on carrier-imposed surcharges, meaning you can use the program to book Star Alliance award tickets with relatively low taxes and fees. And based on the Aeroplan stopover policy, you can book a stopover on a one-way award for just 5,000 points. But you’ll need to pay a partner booking fee of 39 Canadian dollars (about $29) per ticket for awards with partner-operated segments.

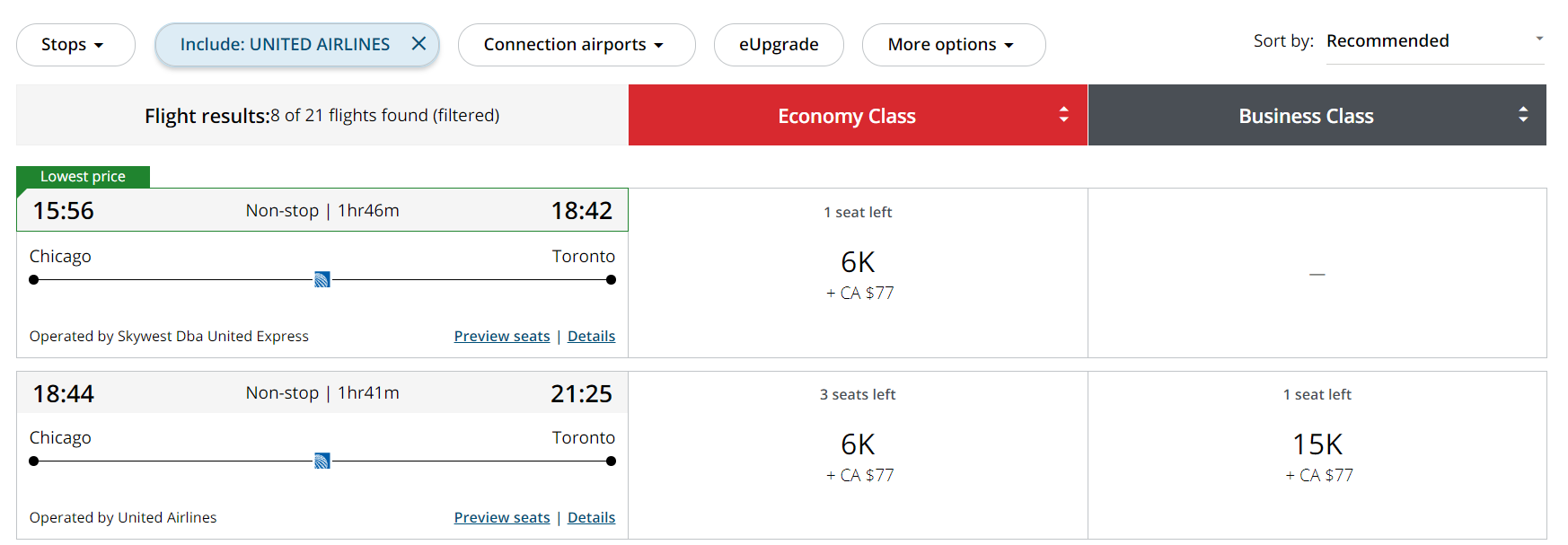

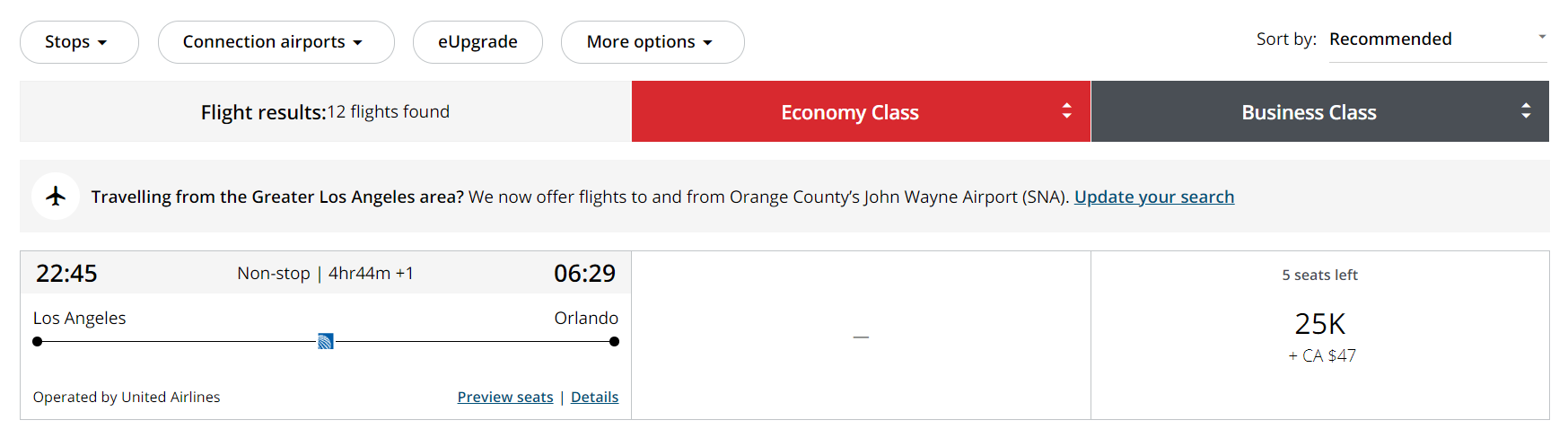

Aeroplan’s partner award chart can provide excellent value on short-haul awards to Canada and international premium-cabin awards. For example, partner-operated flights of less than 500 miles within North America cost 6,000 points each way in economy.

And, if you can find award space, most transcontinental business-class flights operated by United Airlines are 25,000 points each way.

When traveling from the continental U.S. to Europe on one of Air Canada’s partners (excluding Emirates, for which award prices follow the Aeroplan award chart for Emirates and Flydubai flights), you’ll typically pay 35,000 or 40,000 points for economy, 60,000 or 70,000 points for business and 90,000 or 100,000 points for first class. This is because most transatlantic flights from the U.S. fall into the under-4,000-miles distance band or the 4,001-to-6,000-miles distance band.

Related: The best ways to maximize Air Canada’s Aeroplan program

Avianca LifeMiles

Avianca LifeMiles is known for offering cheap redemption rates on Star Alliance partner flights and not passing on fuel surcharges on partner awards.

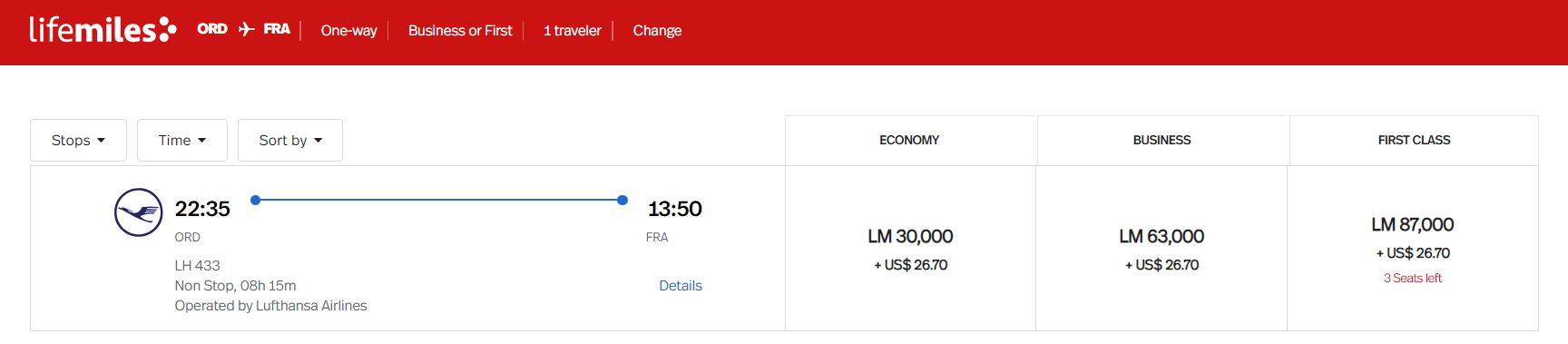

LifeMiles raised award costs to Asia in late 2022, but there are still many things to love about the program. For example, you can redeem 87,000 LifeMiles for Lufthansa first class between Chicago and Frankfurt with $26.70 in taxes and fees.

Thanks to a generous pricing structure for mixed-cabin awards, you might be able to drop that price even further. If you’re flying in long-haul first class and connecting to another destination, it’s almost guaranteed that your connection will be in a lower class of service. Avianca refunds you the difference, meaning adding a connection can make your flight cheaper. For example, here’s an award with the same flight from Chicago to Frankfurt in Lufthansa first class and a short economy flight that would cost you 83,820 LifeMiles plus $39.61.

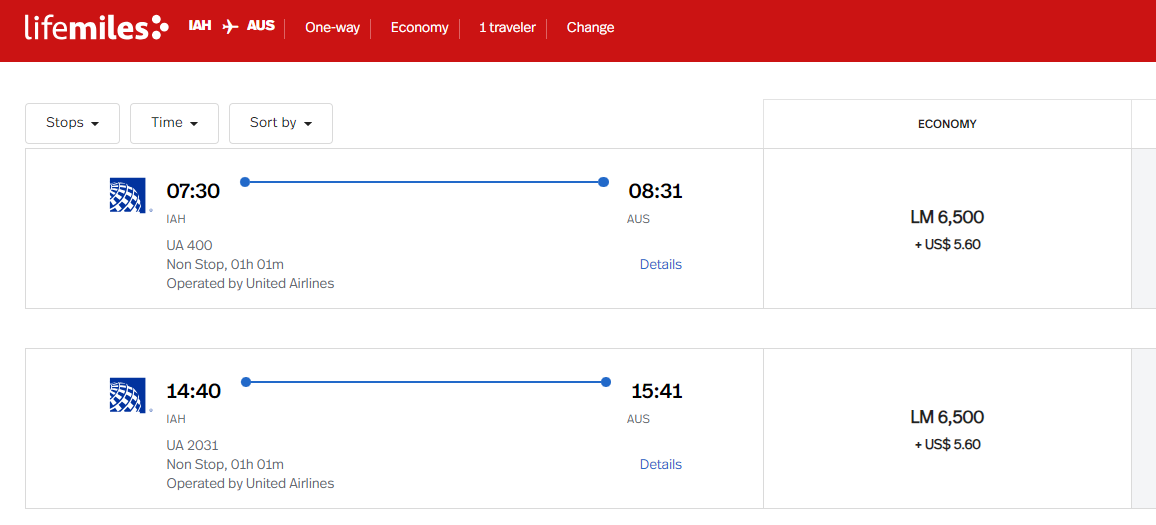

Avianca LifeMiles can also be great for domestic travel on United. Most economy awards within the U.S. cost 13,500 LifeMiles or less each way plus taxes and fees, but you can book plenty of short-haul United routes for as few as 6,500 LifeMiles each way in economy.

Related: Using LifeMiles to book Aeromexico business-class award tickets

British Airways Executive Club

There are many reasons why you should care about British Airways Avios. For example, even after the recent British Airways devaluation, you can still get significant value when you book short-haul American Airlines and Alaska Airlines award flights through British Airways.

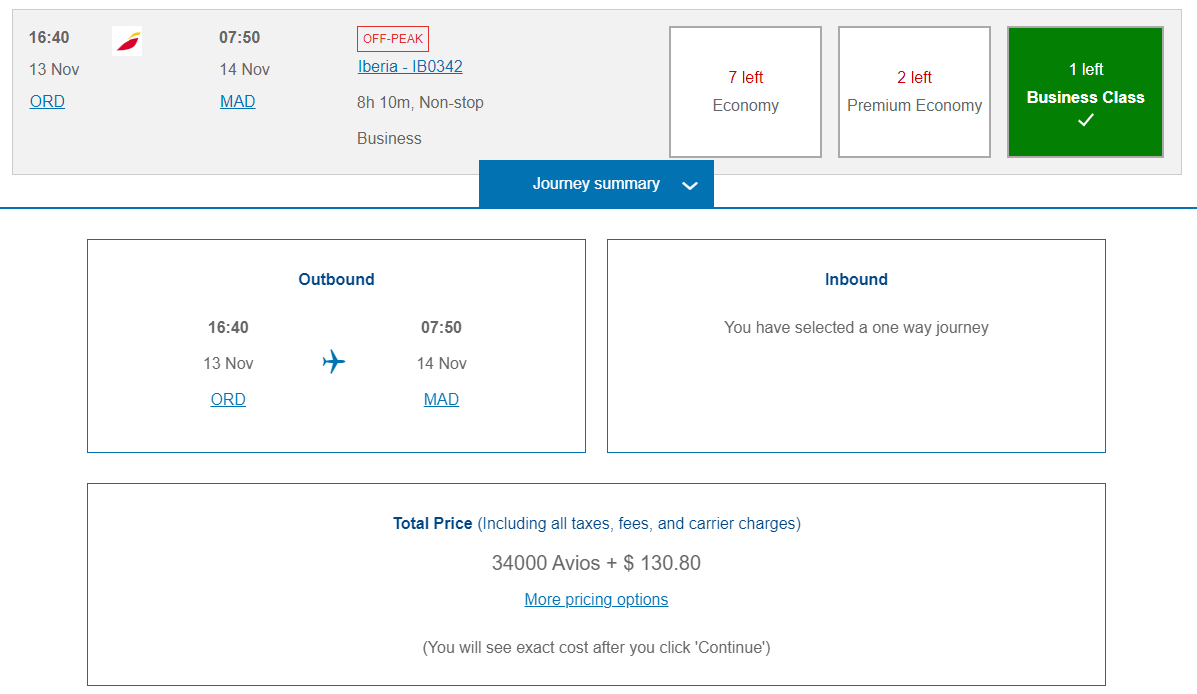

There are also many ways to maximize the British Airways distance-based award chart. For example, you can book off-peak business-class flights from select U.S. cities to Madrid for 34,000 Avios plus about $131 in taxes and fees one-way.

You can also transfer British Airways Avios to Qatar Airways Privilege Club, Iberia Plus, Vueling Club and Aer Lingus AerClub, most of which have sweet spots you can enjoy.

Related: Which airlines can I book with Avios?

Turkish Airlines Miles&Smiles

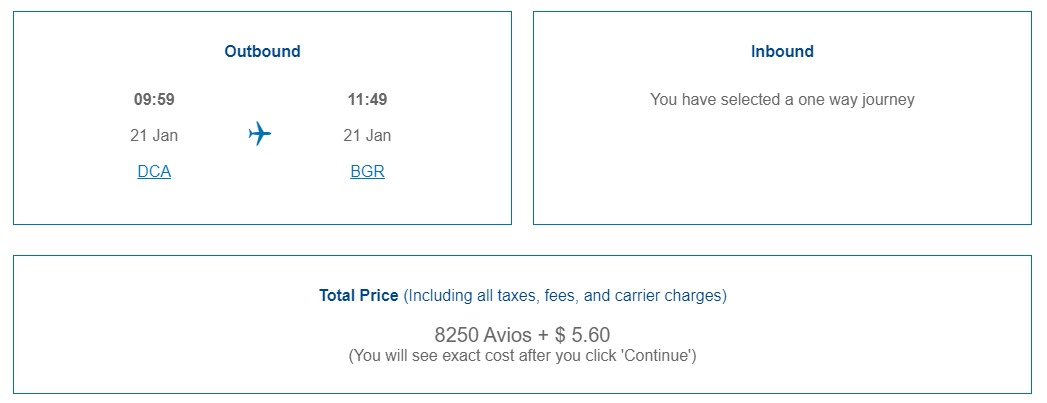

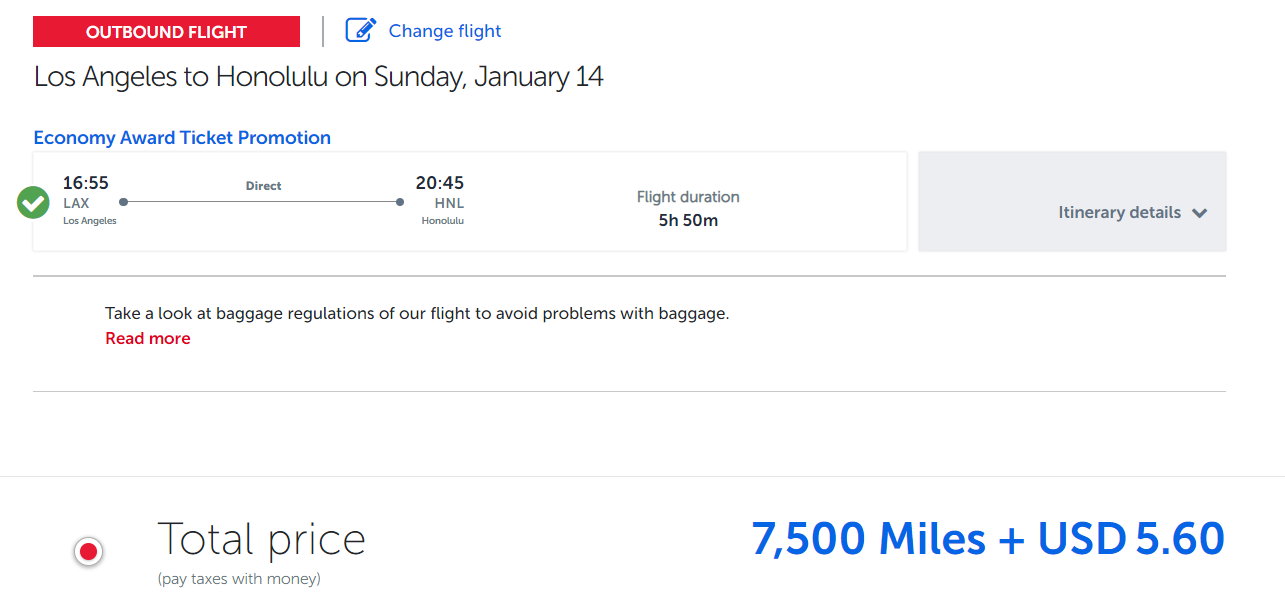

Turkish Airlines Miles&Smiles has plenty to love about it. The program still uses award charts and provides an elusive but appealing sweet spot: United-operated flights to Hawaii for just 7,500 miles one-way in economy.

Fuel surcharges can be problematic if you want to fly select Star Alliance carriers. But you won’t be charged fuel surcharges on United-operated flights, and fuel surcharges are somewhat reasonable on Turkish-operated flights. You can sometimes get good value when redeeming for Turkish-operated promotional award flights.

Related: Turkish Airlines Miles&Smiles sweet spots you can use to maximize your transferable rewards

Virgin Red

Virgin Red is the loyalty program for the Virgin family of brands. Among other things, you can use Virgin points to book flights through the Virgin Atlantic Flying Club program and cruises with Virgin Voyages.

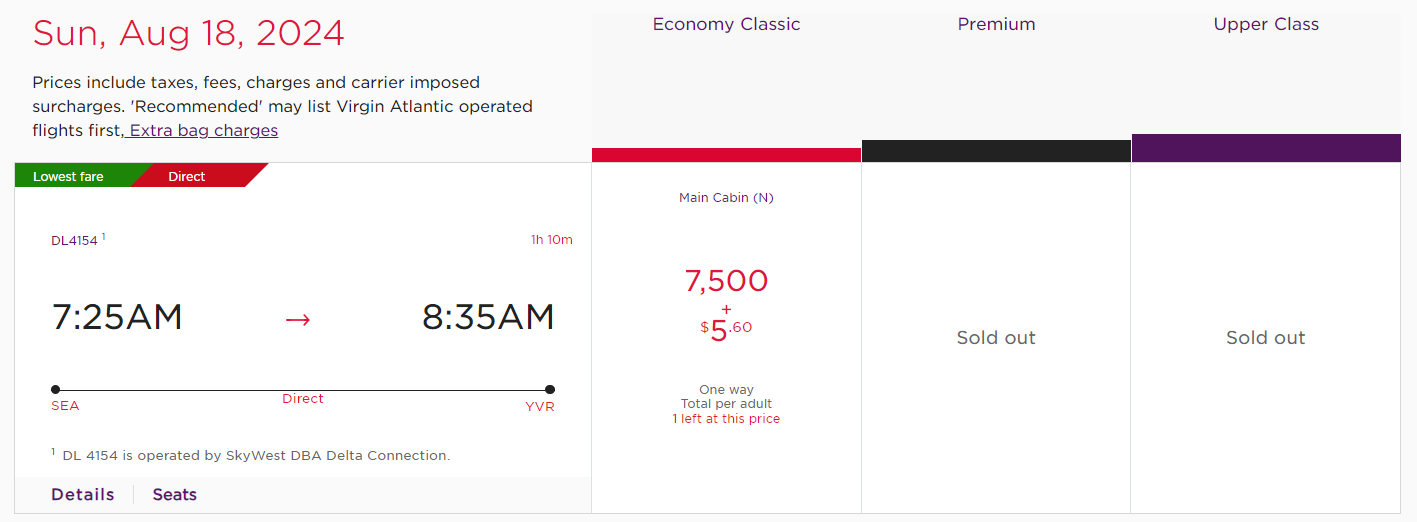

It’s possible to unlock incredible value with Virgin Atlantic Flying Club. For example, you can fly from the U.S. West Coast to Japan in All Nippon Airways business class for 45,000 points one-way (plus taxes and fees), although you’ll need to call to book. And you can still get solid value on some Delta Air Lines-operated awards with Virgin Atlantic Flying Club, such as this flight from Seattle to Vancouver, British Columbia:

Related: How to upgrade your next Virgin Atlantic flight with Virgin points

Mid-tier Capital One transfer partners

Several of Capital One’s transfer partners fall into what we’ll call the mid-tier group. These programs can offer solid value in the right context, but it’s by no means a guarantee. Run the numbers for your bookings before transferring Capital One miles to these programs.

Air France-KLM Flying Blue

Flying Blue, the loyalty program of Air France, KLM, Transavia, Aircalin, Kenya Airways and TAROM, uses dynamic award pricing. This dynamic pricing makes it difficult to discuss specific award pricing as prices fluctuate greatly.

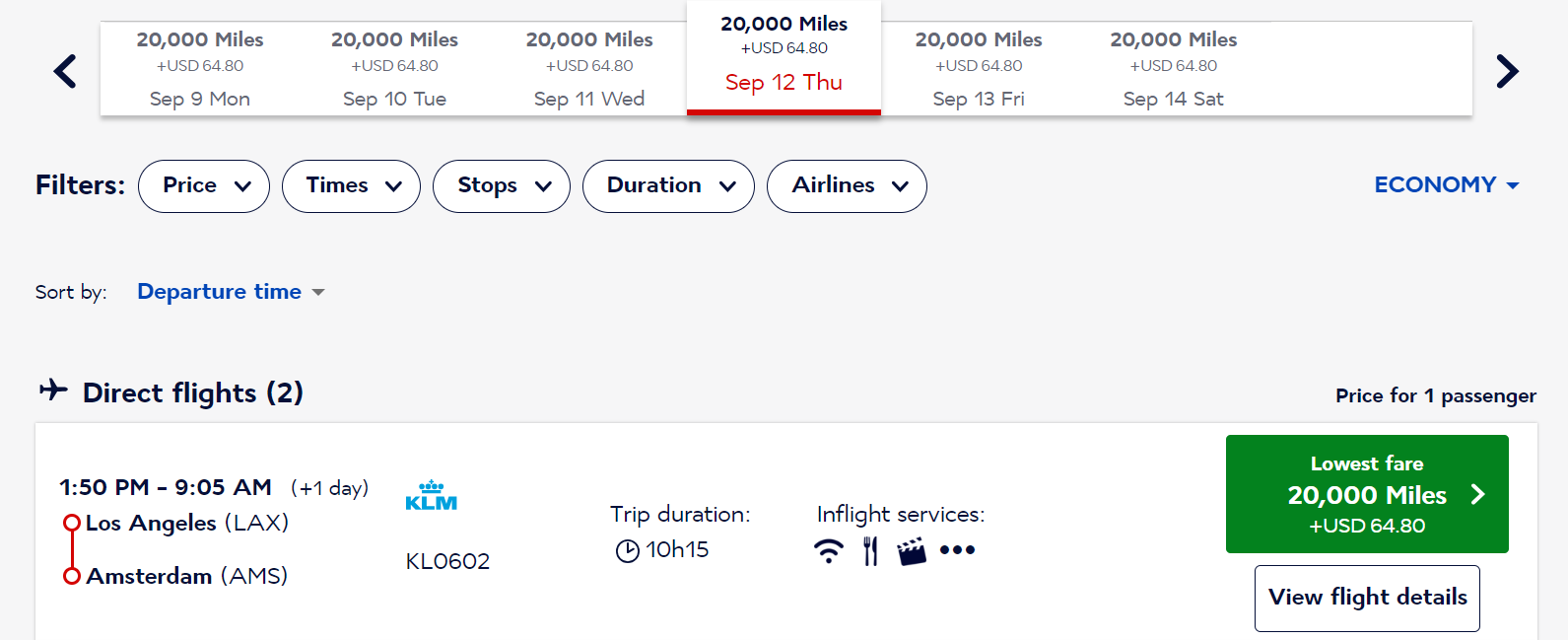

However, there are several Flying Blue sweet spots. For example, Flying Blue can be a good way to book Virgin Atlantic award tickets. And it’s relatively easy to use Flying Blue to fly from the U.S. to Europe in economy for 20,000 miles one-way or less.

Flying Blue also offers monthly Promo Rewards that let you book select award flights at a discount.

Related: Flying Blue stopovers: Extend your trip and book an additional flight at no extra cost

Accor Live Limitless

Hotel chain Accor uses a fixed-value redemption scheme in its Accor Live Limitless program. So, transferring miles from Capital One will always represent a solid — though by no means aspirational — value. Accor Live Limitless allows you to redeem 2,000 points for 40 euros (about $44) off of a stay.

Given the 2:1 transfer ratio, you’d need to transfer 4,000 Capital One miles to get $44 off your stay. Meanwhile, you could get $40 from the same 4,000 Capital One miles if you redeemed your miles for recent travel purchases using Capital One’s fixed-rate redemption option. While it’s only a $4 difference, you’ll get a slightly better value by transferring your miles to Accor if you want to stay at an Accor property.

Cathay Pacific Asia Miles

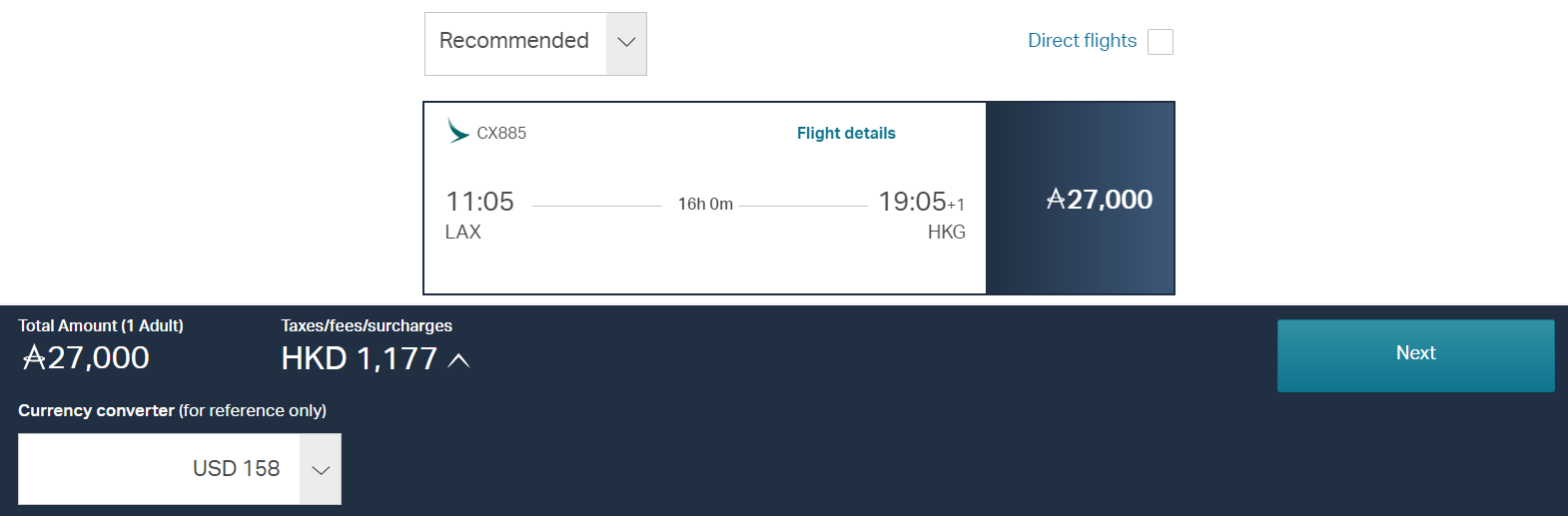

Because Cathay Pacific Asia Miles uses distance-based award charts, this program can be expensive if you want to fly Cathay Pacific to or from the U.S. However, although the Asia Miles changes in late 2023 caused many premium-cabin award rates to increase for Cathay Pacific flights, economy rates dropped in some cases. For example, you can now fly one-way in economy from Los Angeles to Hong Kong for 27,000 Asia Miles plus 1,177 Hong Kong dollars (about $150) in taxes and fees.

Booking British Airways flights with Asia Miles may let you pay lower carrier-imposed surcharges. The Asia Miles program can also be useful if you want to try out Cathay Pacific first class, as Asia Miles sometimes has access to more Cathay Pacific award space than partner programs. However, Cathay Pacific first-class award space between the U.S. and Hong Kong is extremely difficult to find right now.

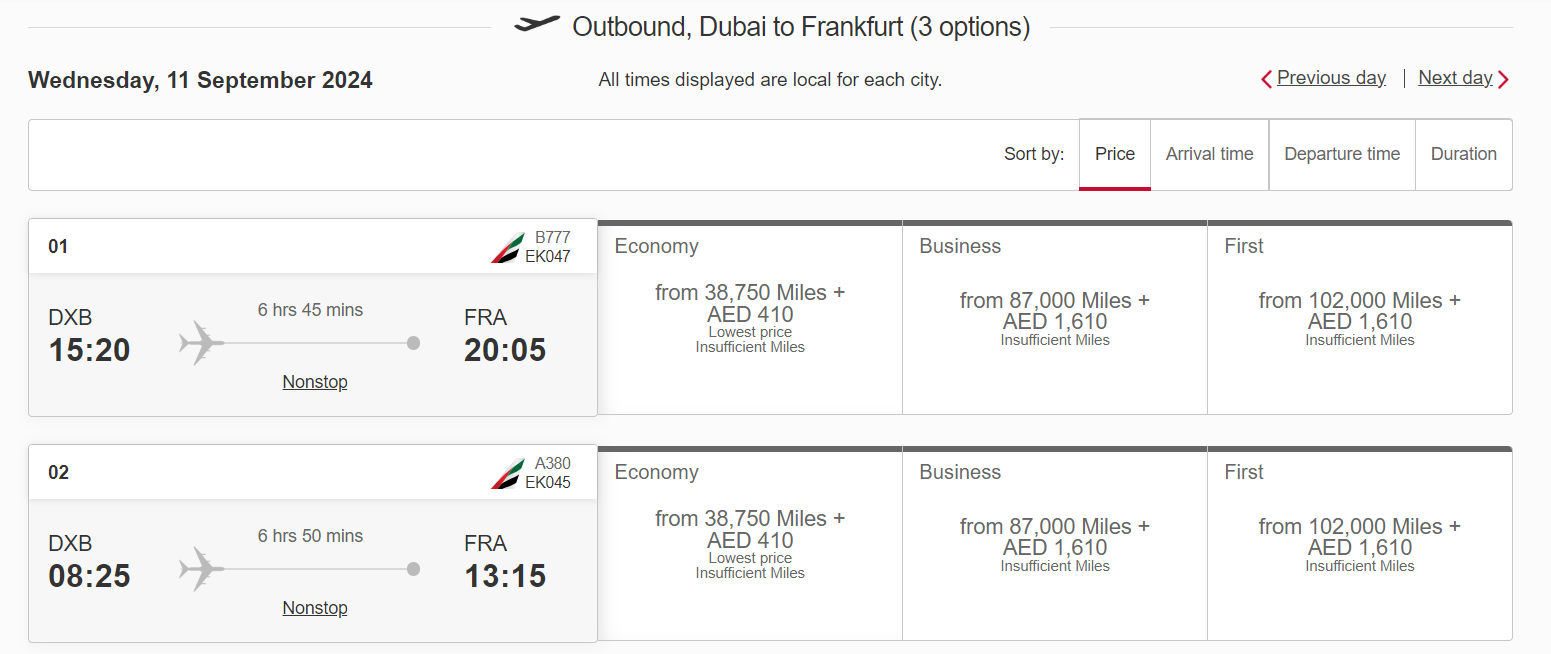

Emirates Skywards

Emirates Skywards can be useful if you want to book one of the carrier’s premium cabins. The award rates aren’t cheap, especially after several devaluations. But Emirates Skywards is the best way to book Emirates first class.

Emirates Skywards also partners with several other airlines, meaning you can also redeem Emirates miles for flights on select partner airlines.

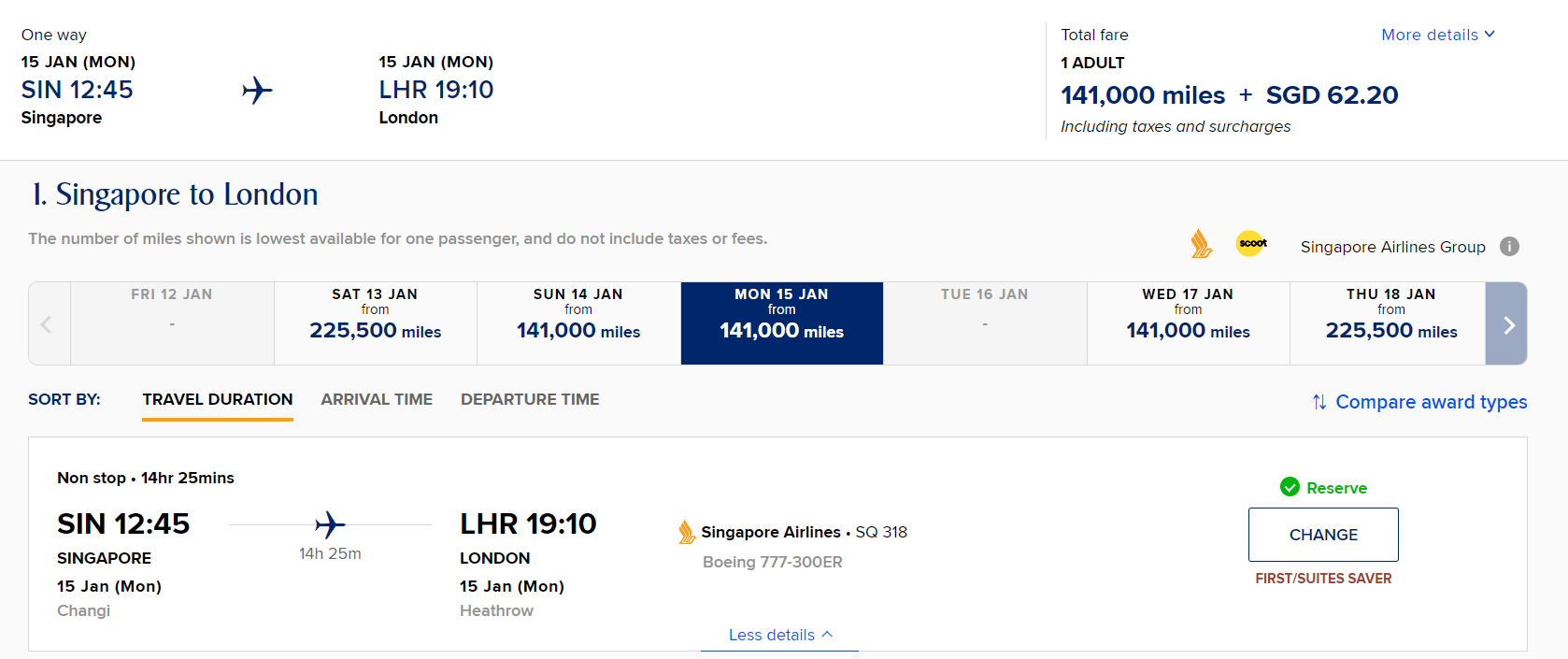

Singapore Airlines KrisFlyer

Several devaluations have marred Singapore KrisFlyer over the last few years. In 2022, the program increased award prices by more than 10% (including awards on KrisFlyer partners).

But, if you want to book Singapore Suites or first class, Singapore KrisFlyer is the program you’ll want to use.

You may also often find good value when you redeem KrisFlyer miles for Singapore Airlines’ Spontaneous Escapes.

Related: You can convert Singapore KrisFlyer miles to Marriott points — but should you?

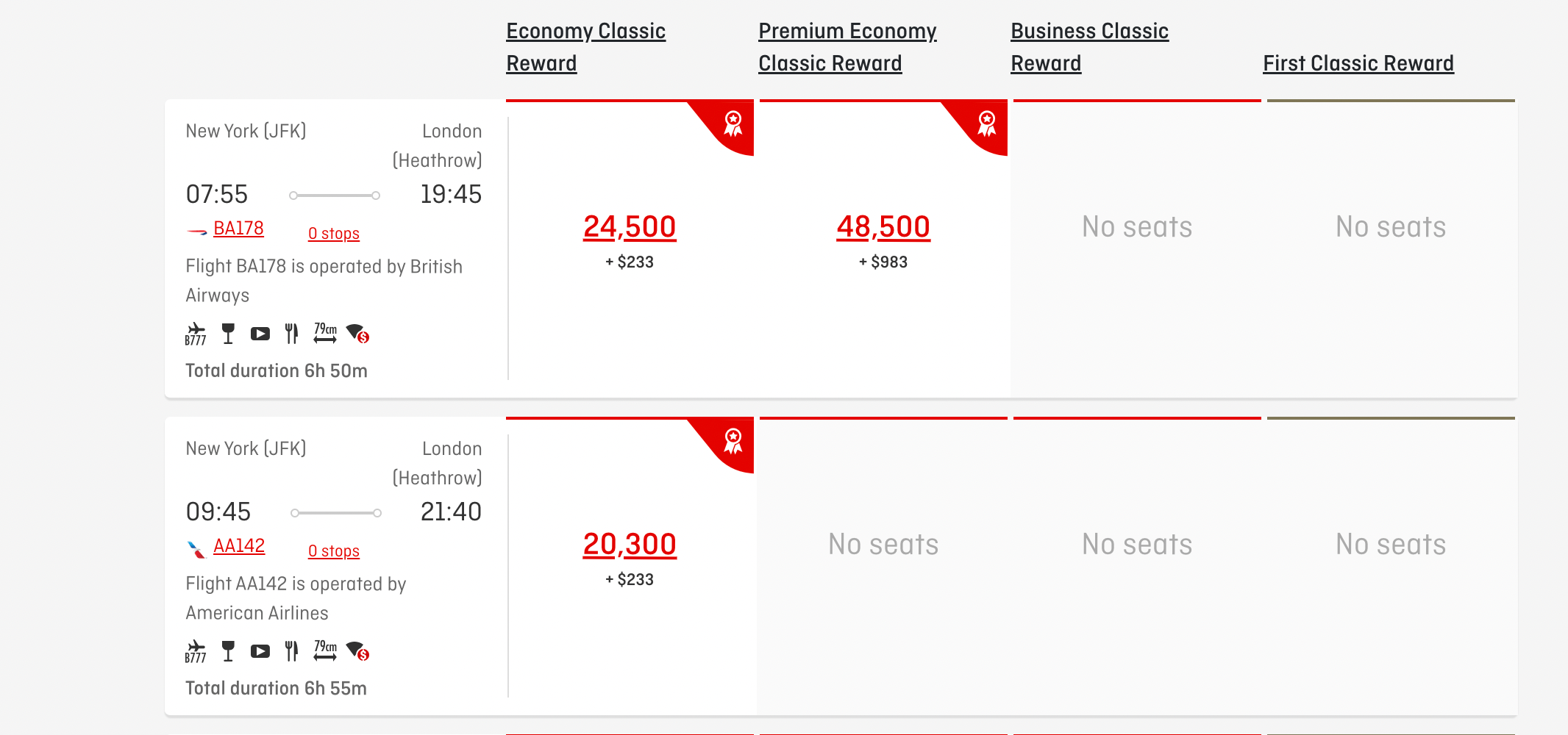

Qantas Frequent Flyer

Qantas Frequent Flyer uses distance-based charts, meaning long-haul flights from the U.S. to Australia are usually prohibitively expensive. However, you can travel from the East Coast to Europe for about 20,300 points. One example is a nonstop American Airlines flight from New York’s John F. Kennedy International Airport (JFK) to London’s Heathrow Airport (LHR) for under 21,000 points.

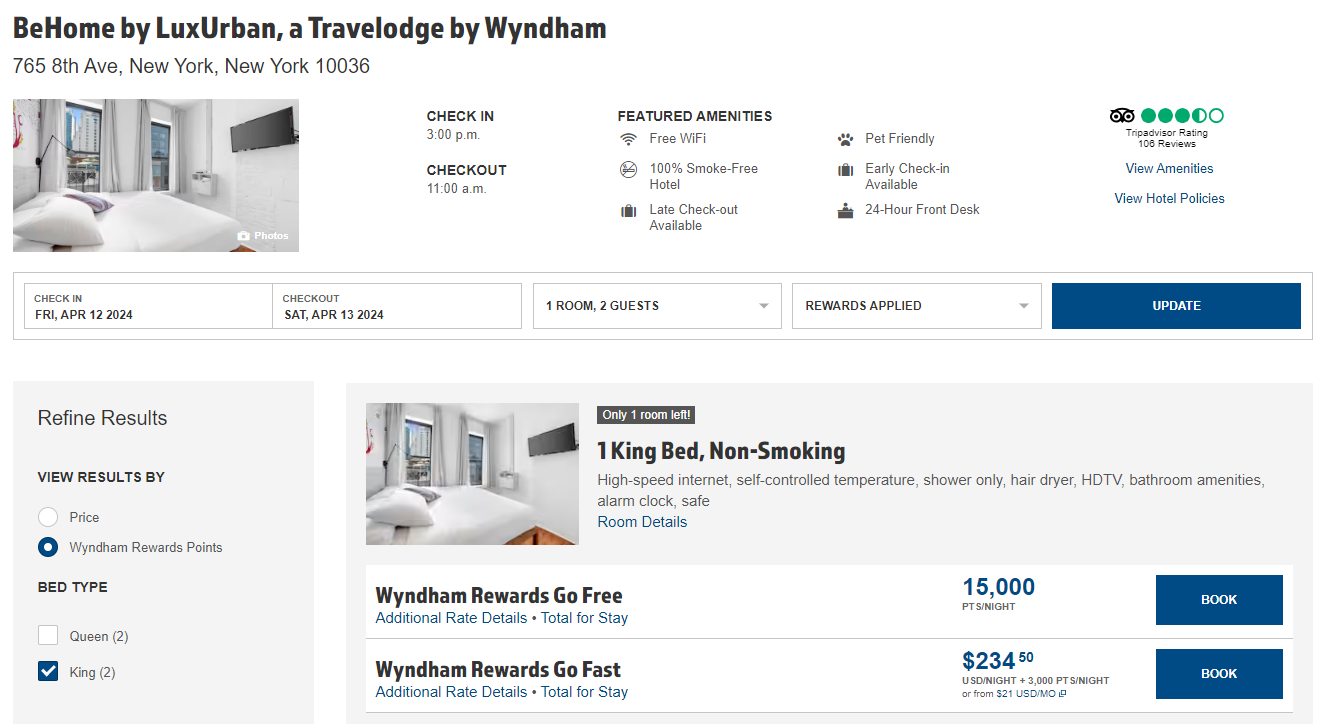

Wyndham Rewards

TPG’s valuations only peg Wyndham Rewards points at 1.1 cents each. But it’s certainly possible to get more value when redeeming Wyndham points. For example, you can redeem Wyndham points for home rentals at a flat 15,000 points per bedroom per night.

Using the three-tier Wyndham Rewards award chart for expensive nights can also offer high value. One example is the BeHome by LuxUrban, a Travelodge by Wyndham on Eighth Avenue in New York City, where you can book various room types for 15,000 points per night.

If you had paid cash for the above night, the rate would have been $324.80 per night, including taxes and fees. So, you’d get a redemption rate of 2.16 cents per point if you booked an award stay on this night.

Related: The best Wyndham hotels in the world

Capital One transfer partners to avoid

Between expensive award charts, bad transfer ratios, hidden fees and programs that are difficult to navigate, you’ll likely want to avoid some of the Capital One transfer partners. However, just because we don’t usually recommend transferring Capital One miles to these programs doesn’t mean they don’t have any redeeming qualities.

Aeromexico Rewards

Aeromexico Rewards uses dynamic pricing for most award flights, and the rates are often high. For example, this one-way award flight from Mexico City to Atlanta carries a massive 2,285 Mexican pesos (about $135) in taxes and fees.

However, the program does have at least one bright spot: an around-the-world award ticket that lets you stop in up to 15 destinations. You have to call to book, but the ticket costs 224,000 points in economy class and 352,000 in business class.

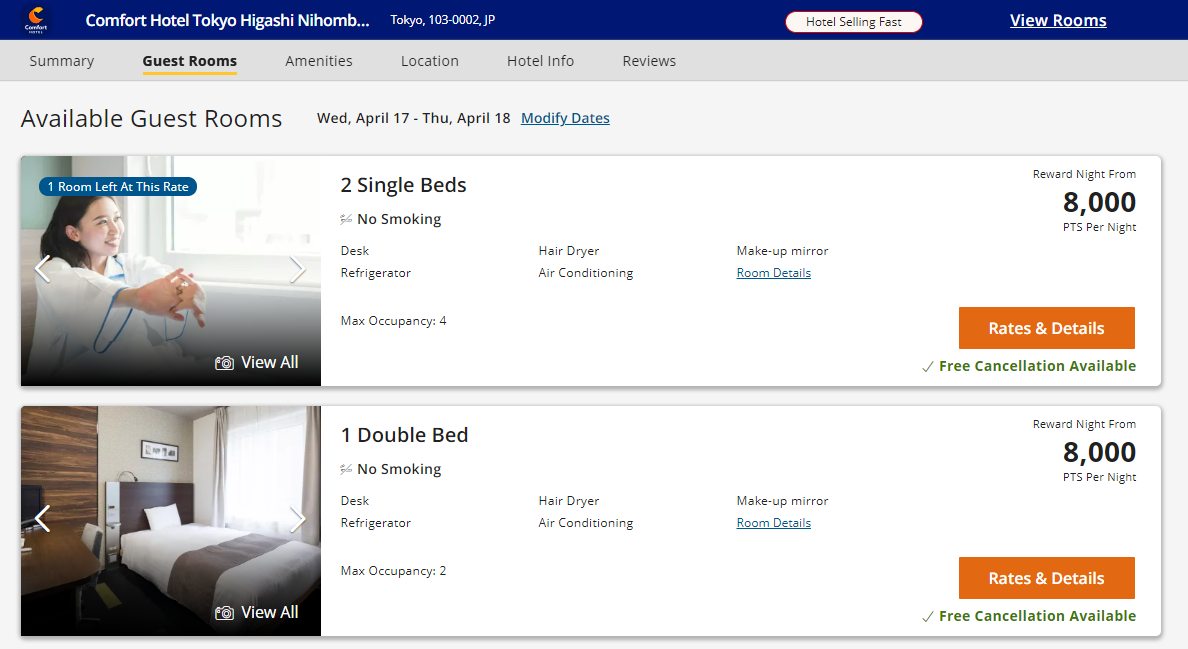

Choice Privileges

There’s a lot of value to be found in the Choice Privileges program. For example, you can book nights for 8,000 points in Tokyo.

But, since TPG’s valuations peg the value of Choice points at 0.6 cents per point, transferring Capital One miles to Choice Privileges usually won’t make sense. Instead, consider buying Choice points during a sale or signing up for a Choice Privileges credit card if you want to earn Choice points.

Related: Redeem Choice points for a Maldives resort, half-board hotels, suites and more

Etihad Guest

Despite not being a member of any major alliances, Etihad Guest has many partners, including American Airlines and Air Canada.

However, Etihad Guest removed its ample sweet spots in March 2023 when it introduced a new standardized award chart. Unfortunately, Etihad and partner airline redemptions now often require many more miles than the amount listed on the new award chart. To this point, a note for the award chart states, “The miles displayed are indicative values.” As such, although you may still want to price out award flights through Etihad Guest, you likely won’t like what you see enough to transfer Capital One miles to Etihad Guest.

Related: Complete guide to Etihad Guest, now with simplified award charts and limited sweet spots

EVA Air Infinity MileageLands

Capital One already partners with two of the best Star Alliance programs for booking awards — Avianca LifeMiles and Air Canada Aeroplan — so there’s rarely a reason to bother with EVA. EVA’s award chart is usually more expensive, and the program is often difficult to navigate.

Finnair Plus

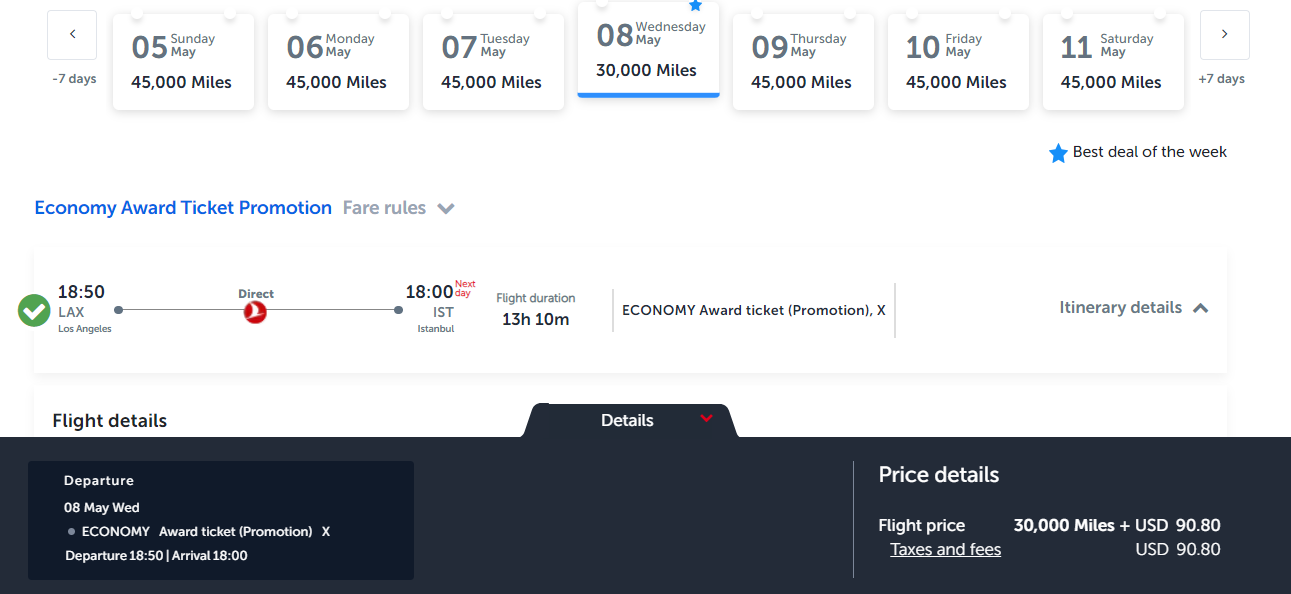

Finnair’s award rates are usually reason enough to avoid the program. For example, one-way Finnair-operated awards between Europe and Asia, North America, Doha or Dubai cost 45,000 points in economy, 65,000 points in premium economy and 95,000 points in business class. But you can sometimes get good value when you use Finnair points to upgrade your flight.

Finnair will replace Plus points with Avios as its loyalty currency March 9. Finnair Plus points will convert to Avios at a 3:2 ratio, but award rates will also be recalculated with the same 3:2 ratio. As such, the program’s value likely won’t change significantly.

Related: The best websites for searching Oneworld award availability

TAP Air Portugal Miles&Go

TAP Miles&Go has award charts. For example, here’s the chart for one-way TAP-operated awards from North America in economy:

But in practice, you’ll see other (often higher) rates when you do an award search. For example, here’s the lowest fare for a one-way economy award flight from New York to Lisbon on a randomly selected date:

During sales, you can also occasionally buy TAP miles for under 1 cent per mile. So, even if you want to book an award flight using TAP miles, transferring Capital One miles likely won’t be your best option for earning TAP miles.

Related: TAP Air Portugal launches new credit card for US travelers

Bottom line

Some excellent Capital One transfer partners can almost single-handedly carry the value of Capital One miles.

However, not every transfer partner will provide outsize value, so remember to compare the cash price of your ticket or hotel stay before transferring Capital One miles. Sometimes, buying a paid ticket (or stay) and then redeeming Capital One miles at a fixed value to cover your recent travel purchase will yield more value.