Editor’s note: This is a recurring post, regularly updated with new information.

Consider two scenarios for booking an award flight to Europe: In the first, you redeem 60,000 miles for a round-trip economy award. In the second, you pay 20,000 points for a one-way economy award. Which provides the better value?

You may be inclined to say the second scenario, but it’s a trick question. Both scenarios lack the context to evaluate whether either represents a good deal, much less which provides better value.

In short, the cost in points or miles is insufficient to tell you whether the award is a good deal. So, let’s look at how to decide when to use your points and miles and how to calculate your redemption value.

Deciding when to use points or miles

Getting value from your points and miles starts with knowing their worth. Every month, TPG publishes valuations for all the major loyalty programs. We also update our award calculator to help you decide when to redeem points or miles and when to book a paid rate.

Using the TPG calculator

Using the TPG calculator is easy. Select whether you would like to calculate the value of airline miles or hotel points, and then choose a program. Enter the fields completely, including any fees you must pay on your award.

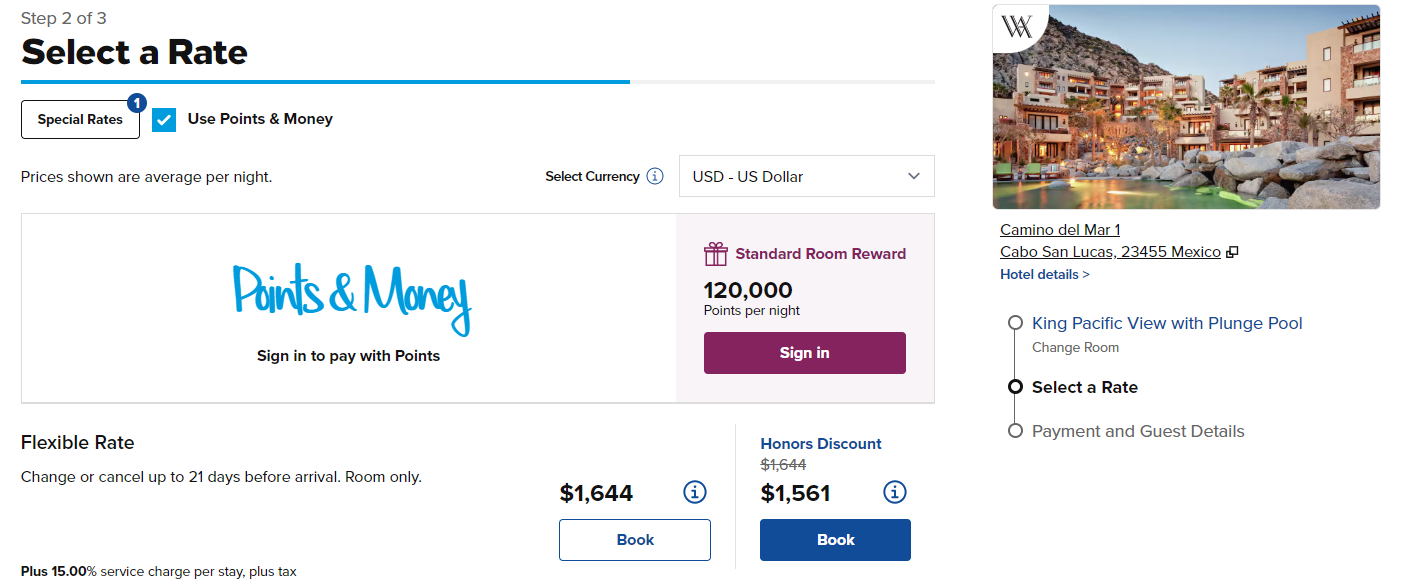

For example, let’s say you wanted to book a five-night stay at the Waldorf Astoria Los Cabos Pedregal. Rates will vary based on your dates. But, in an example we found, you could pay $10,549.75 or redeem 480,000 points (after Hilton’s fifth-night-free benefit for elite members on award stays) for a Pacific-view room with a king bed and a plunge pool.

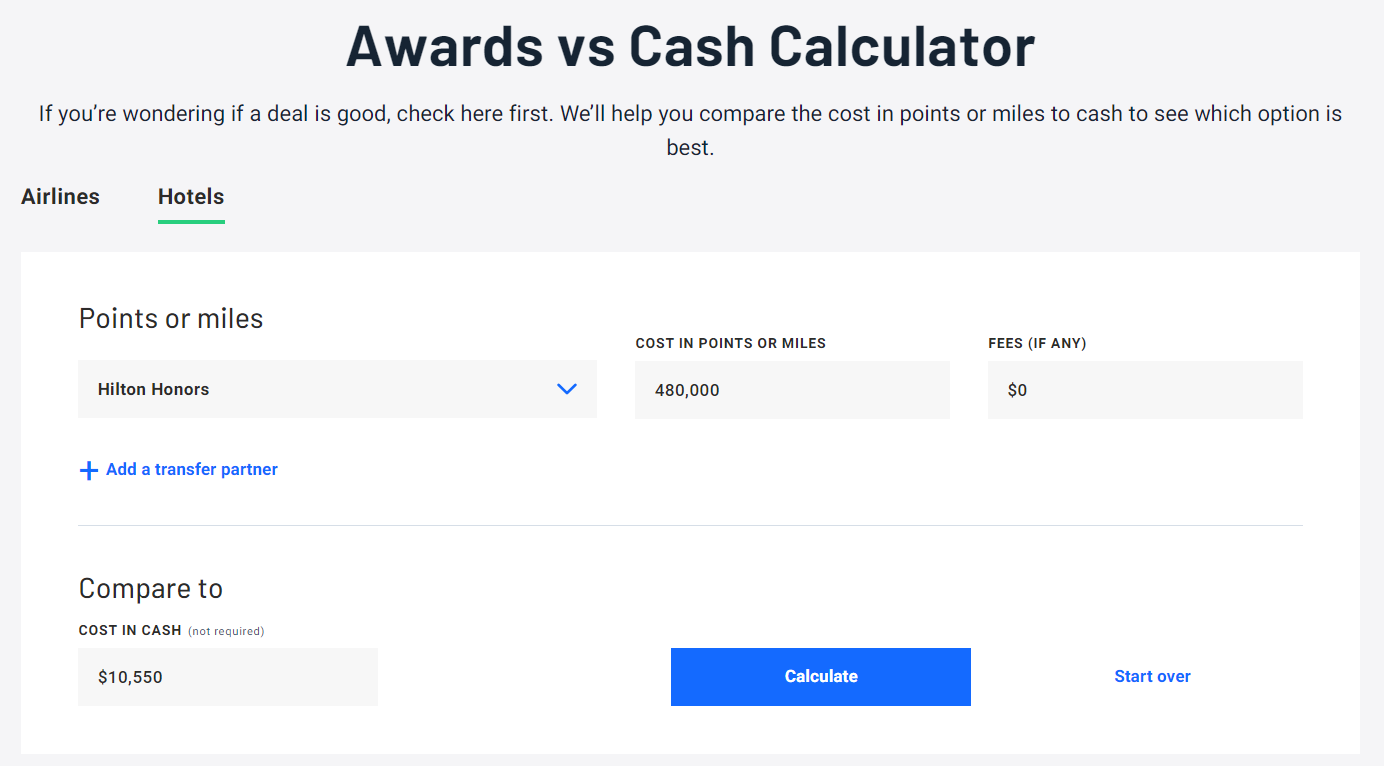

You can use the TPG calculator to determine your potential redemption value and whether you should redeem Hilton points or book a paid rate for this stay. Since there aren’t any fees on this award stay, you’ll put “$0” in the fees field.

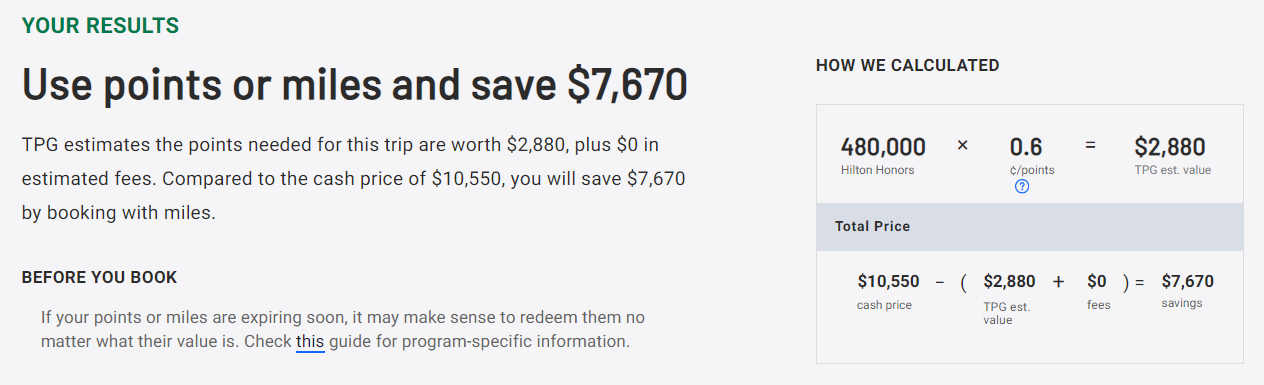

Select the “Calculate” button once you’ve input your data. In this case, TPG values 480,000 Hilton Honors points at $2,880. Since the cash price of the hotel is (far) greater than $2,880, the calculator recommends redeeming Hilton points.

You can see the calculation on the right-hand side of the above screenshot. By studying this calculation, you can learn how to calculate when to use your rewards or book a paid rate.

Related: 10 apps and websites that make award redemptions easier to find

Calculating your redemption value

Redemption value is a metric to determine when to redeem your points or miles and when to book a paid rate. You can calculate your redemption value by multiplying the cash price ($10,549.75) by 100 and dividing the result by the award price (480,000 points).

By doing so, you’d learn the above Hilton stay would give you a redemption value of roughly 2.20 cents per point. TPG’s valuations peg the value of Hilton Honors points at 0.6 cents per point, meaning you’d be getting over three times our valuation of Hilton points.

Whenever you’re considering a redemption, you’ll want to ask yourself, “Should I use my points and miles now, or am I better off saving them?” Of course, only you can decide based on your situation. But, if you are in a position to either use cash or your points and miles, use the following guidelines:

- If you calculate your redemption value to be higher than our valuations, lean toward booking an award.

- If you calculate your redemption value to be lower than our valuations, lean toward booking a paid rate.

- If you calculate your redemption value to be equal to our valuations, other factors — which we discuss below — may help you decide.

Related: How (and why) you should earn transferable credit card points

Accounting for taxes and fees

You must include taxes and fees when using the TPG calculator or calculating your redemption value.

Hotel-related taxes are often set by a percentage of the cash rate. So, if you’re paying $200 for a hotel and the taxes add up to 10%, you can expect around $20 in taxes. Using points, on the other hand, your cash rate is $0, so you would incur no taxes. Points and miles can be a great way to avoid paying hotel-related taxes — especially in destinations with sky-high tax rates.

Resort fees are trickier, as some hotel loyalty programs waive resort fees on award stays or for top-tier elite members. For example, World of Hyatt members don’t pay resort fees on award stays, and top-tier Hyatt Globalist members also don’t pay resort fees on eligible paid stays.

Before booking, you can see the full cash rate — including taxes and resort fees — on the final reservation screen. Your options might be as follows for a Marriott stay, as Marriott Bonvoy doesn’t waive resort fees on award stays:

- Redemption stay: 80,000 points plus $50 in resort fees

- Paid stay: $1,200

To correctly calculate the award redemption, you would add taxes and fees on the award booking ($50 of resort fees in this case) into the “Fees” box on the calculator. The calculator subtracts these taxes and fees from the paid rate of the hotel. After all, we’re ultimately comparing $1,150 to 80,000 points.

TPG values 80,000 Marriott points at $672, so you’re better off redeeming Marriott points in this example since the cash rate is much higher.

We can also calculate the redemption value by multiplying the cash price ($1,200) less the award taxes and fees ($50) by 100 and then dividing the result by the award price (80,000 points). Doing so would reveal we’re getting 1.44 cents per Marriott point, which is higher than TPG’s valuation of Marriott points at 0.84 cents each.

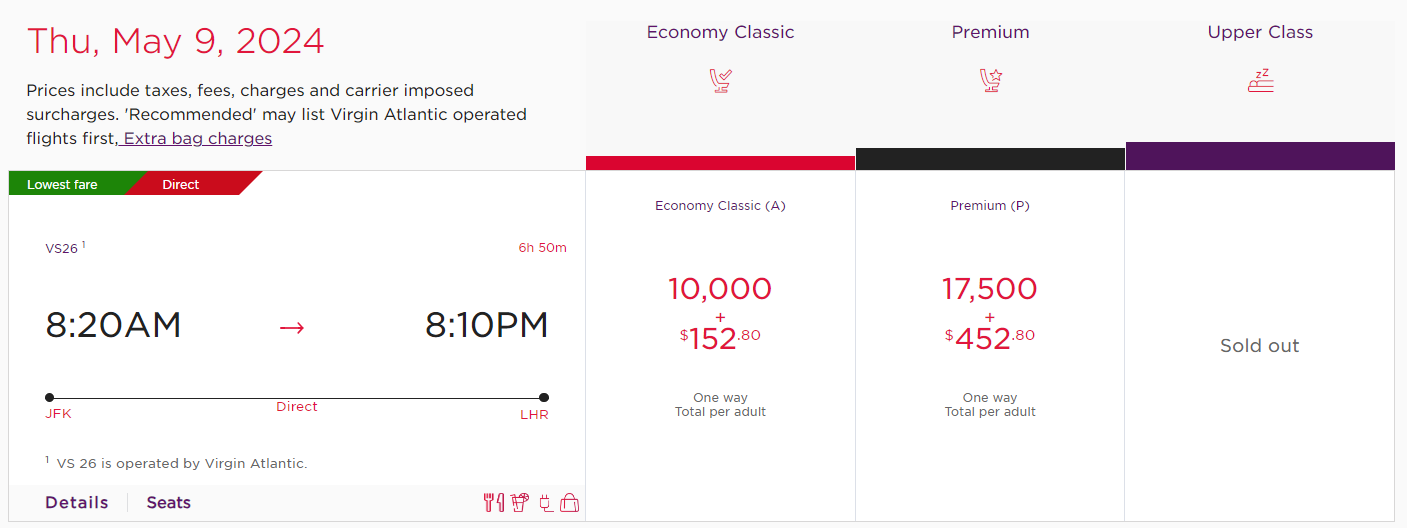

It’s also important to consider carrier-imposed surcharges when booking award flights, as these can offer an even more pronounced example. For example, consider the following Virgin Atlantic Flying Club award options. Especially given how inexpensive paid rates can be for transatlantic flights, it’s not unheard of that you might find paid flights bookable for less than the taxes and fees on these awards.

In this scenario (and the others above to a lesser extent), failing to account for fees would paint a distorted picture of the redemption value.

You can use the same approach when calculating the redemption value of mixed points-and-cash awards. Input the cash price of your itinerary like normal, deduct the cash portion of your award as if it were any other fee, and divide the remaining amount by the points portion of your award.

Related: Tourism taxes are making international trips more expensive

Other considerations

In addition to fees, your calculation should include any expenses you wouldn’t have incurred on a paid itinerary. You may also want to consider the opportunity cost of the rewards you could’ve earned on a paid flight or stay.

We’ve compared apples to apples when calculating redemption values, but you don’t necessarily need to base your assessment on identical itineraries. Suppose you want to fly from San Francisco to Los Angeles, and you can buy an Alaska Airlines ticket for either 10,000 miles plus $5.60 in taxes and fees or $150. That would give you a redemption value of about 1.5 cents per mile.

However, let’s say Southwest has a similar flight for $100. Setting aside factors that aren’t strictly pertinent to the calculation (like bag fees, seat selection and elite qualification), you may want to use the Southwest flight cost and lower the redemption value to about 1 cent per mile. In short, you must decide whether your options are similar enough to be interchangeable. If the schedule is close and you expect the experience to be comparable, you may want to base your calculation on the cheaper option.

Finally, one controversial question in the award travel community is whether it’s reasonable to base redemption value on a cash price you would never actually pay. For example, you could get an outsize return on a premium award for a flight that normally costs tens of thousands of dollars. But if you would only be willing to pay a fraction of the price if you booked a paid rate, should you use that lower rate when calculating your redemption value?

Related: Save miles or money and unlock better availability with positioning flights

Bottom line

The calculations discussed in this guide can help you evaluate whether you’re getting a good return. But these calculations shouldn’t dictate whether you book an award.

A suboptimal award can be a great redemption if you are short on cash but have points to redeem. There are various ways to use your rewards for unique experiences for which it is difficult (or impossible) to peg a true value. It’s up to you to decide whether a given award makes sense.