You might consider a 100,000-point welcome bonus on a new credit card to be a huge haul, and it is, but not all points balances are created equal.

Business owners with significant monthly business expenses could find they are earning points even faster than they can redeem them with the right credit card.

In the past, we’ve seen some impressive point balances from readers (and even TPG staffers), but this might be the largest yet.

Here’s how you can spend millions of credit card points.

Can you have too many travel rewards?

TPG reader Larry M. contacted us looking for some advice on how to use his points. He’s been collecting Membership Rewards points through his American Express cards for over 13 years and would like to book a cruise using them.

Larry currently has a staggering 27 million Membership Rewards points, as well as 3.8 million Hilton Honors points, 1.8 million Marriott Bonvoy points and 2.8 million American Airlines AAdvantage miles.

He earned most of those on The Business Platinum Card® from American Express. He usually redeems around 1 to 1.5 million points for travel each year.

He specifically asked how many points it would take to pay for a $10,000 cruise with the Amex Business Platinum versus the Chase Sapphire Reserve® or another card that TPG recommends.

How to maximize millions of credit card rewards

The Points Guy founder, Brian Kelly, shared his advice in his recent weekly newsletter:

You’ll get the best value for those Amex points when using them for airfare — whether transferring to airline partners or through Pay with Points using your Amex Business Platinum card to get the 35% rebate on certain flights.

That said, Amex points are not great when redeeming for cruises. Through Amex Travel you’re only getting around 0.7 cents per point.

There are no good cruise credit cards, so forget that. What you really need is a solid cash-back charge card — ideally one with no preset spending limit or a large credit line (because you spend a lot). Many cards offer 2% back on all purchases without worrying about any bonus categories.

Let’s do the math on this — for every $1 million you spend, you’re going to get $20,000 in cash back. You can use that cash back to buy cruises, rental cars, you name it. In contrast, 1 million Amex points, when you redeem for a cruise, would be worth $7,000. So, you’d get nearly three times the value by spending on a 2% cash-back card.

I think it’s time to stop putting all the spending on the Amex and start earning cash back. The thing with cash back versus points is that you can invest the cash and it can grow over time. Your Amex points balance is not increasing in value over time.

So use your stockpile of Amex points for flights and hotel points for hotels, and use your cash back for everything else.

Let’s break down some of Brian’s advice:

- The Business Platinum Card from American Express offers American Express Travel’s Pay with Points feature, which allows you to receive a 35% rebate when you use points toward first- and business-class flights on any airline and economy-class flights on your selected airline. The 35% rebate is capped at 1 million points back per calendar year. If Larry were looking for an easy way to redeem his points, perhaps to join a cruise departing from Europe or Asia, he could easily redeem his Membership Rewards points for 1.54 cents each without worrying about transfer partners or award availability.

- While Larry could book cruises using his Amex points, this is not a great way to use them as he would only receive 0.7 cents per point in value.

- Rather than earning millions of points he may not easily be able to use, Larry could consider a business credit card that earns generous cash back, which he could use to pay for any cruise he wished. While it might not be as sexy as the Business Platinum Card, Larry could consider the Capital One Spark Cash Plus, which offers a sign-up bonus of $1,200 after you spend $30,000 in the first three months of card membership with an annual fee of just $150 (see rates and fees) — which is waived when you spend $150,000 on the card in a year. Plus, he’d earn an unlimited 2% cash back on every purchase, everywhere — with no limits or category restrictions. A million dollars spent on this card each year would earn Larry $20,000 in cash back (plus the $1,200 welcome bonus), enough to pay for two luxury cruises each year.

Related: Best business credit cards of 2024

Other redemption options

If Larry were to switch to a cash-back credit card, he still has an eye-watering number of Membership Rewards points he could use. While his focus is on cruises, he has so many points he could easily consider some other travel.

Here are some recommendations:

- Fly a family of four in business class round-trip to Europe for 400,000 Membership Rewards points by transferring them to Air France-KLM’s Flying Blue program and using the flexible calendar search to find availability across the year.

- Larry could transfer Membership Rewards to Singapore Airlines’ KrisFlyer program to fly a family of four to and from Singapore in business class on the world’s longest flight, booking more readily available Advantage awards for 287,000 points per person (so just over 1 million Amex points). That could be even cheaper if he’s able to find saver-level awards — though these tend to be quite scarce on this route.

- With that many Amex points, it’s unlikely Larry would ever need to fly economy again. However, transferring his Membership Rewards to British Airways Executive Club would allow him to book flights to Hawaii from just 16,000 Membership Rewards each way on American and Alaska Airlines from the West Coast. Domestic first-class flights cost a higher 42,000 Avios each way, but if he can find availability, this could still be a great redemption option.

Larry also has nearly 3 million American miles, and with the AAdvantage program’s switch to dynamic pricing for AA-operated flights, Larry’s balance could be quickly swallowed up. Just a few long-haul trips with his family could do it, as it’s not unusual to see 400,000 AAdvantage miles per flight in premium cabins.

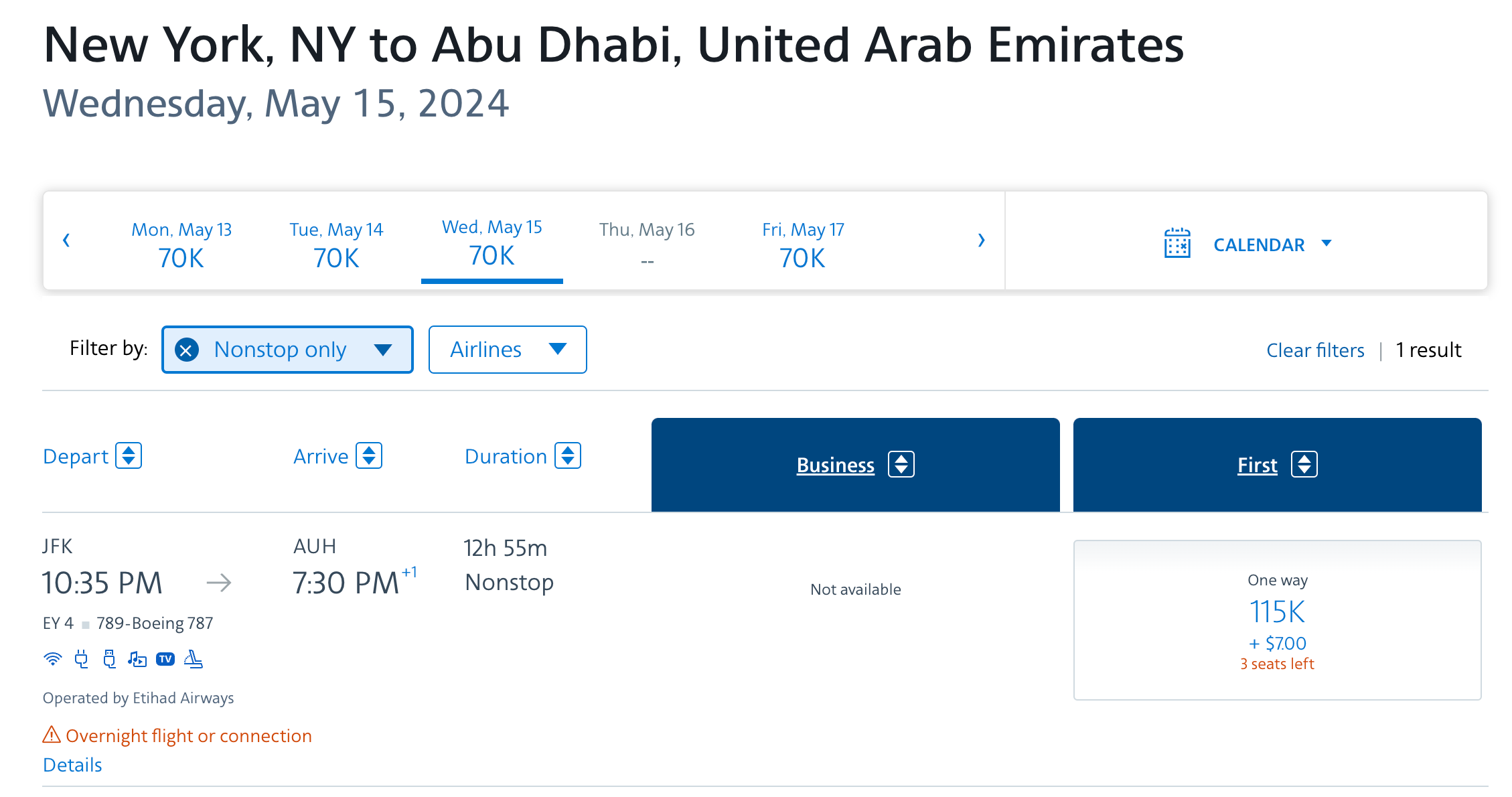

Fortunately, AA has, for now, retained an award chart for flights operated by partner airlines. While British Airways should generally be avoided due to its high carrier-imposed surcharges to Europe, there are plenty of great deals to be found if Larry can book either well in advance or at the last minute on the likes of Japan Airlines, Iberia, Etihad Airways and Qatar Airways.

Larry also has seven-figure balances of hotel points. Here are some of our favorite uses of Hilton Honors and Marriott Bonvoy points.

Best travel credit cards to earn points and miles

While you won’t earn 35 million points from a single welcome bonus, it’s easy to earn lots of valuable points and miles with the right travel credit card. Here are some of our favorites offering great welcome bonuses right now:

- The Platinum Card® from American Express

- American Express® Gold Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Ink Business Preferred® Credit Card

- Chase Sapphire Preferred® Card

Any of these could allow Larry’s balances to grow even further.

Bottom line

Larry’s points problem is an envious one to have. He already has a lifetime of Membership Rewards points, with at least a million extra points rolling in yearly.

While he could get great value using his existing Membership Rewards points to book flights to position to and from the cruises he likes to take through his Business Platinum’s Pay with Points feature, booking cruises this way isn’t a great way to use his eight-figure balance.

Instead, he could consider a cash-back card that will earn him 2% on every purchase. He could then use those rewards to book any cruises he likes.

As for redeeming his existing points for flights or hotel stays, the skies are the limit.